(Mint Press) – North Dakota is becoming an unequal battleground between those profiting from the exploitative oil trade and those who do not. On Feb. 4, House Bill No. 1421 was defeated on the grounds that it duplicated benefits that the federal government already offered, forcing low-income families to over-stretch their budgets further.

So, what exactly did the bill ask for? The bill asked the state to offer $1 million toward buying milk or juice for low-income children. These children are already eligible for the federal free breakfast and lunch program, but this extra milk or juice would be a supplement for many children that could use the nutritional boost.

In Vermont, a similar bill that would have closed the loophole in the federal school lunch program which pass the remainder of costs, not covered by federal subsidies to the students. The cuts to federal funding is creating real hardship for low income, and encouraging more tax breaks for the rich.

“We are talking about 2 million cartons of milk or juice over two years — that was unacceptable to the committee,” North Dakota House Assistant Minority Leader Corey Mock (D-Grand Forks), an Education Committee member told The Huffington Post. “In another committee room, we were talking about giving tax breaks equivalent to 100 million cartons of milk over five years.”

Currently children who wishes to have a second milk for their mid-morning breaks must pay for it. “It is a duplicate, it is already being done,” Rep. Mike Schatz (R-New England) said. “Why would you do it again? That is the reasoning.”

Children who are bussed in from rural consolidated school districts typically arrive at school too late to take advantage of the breakfast program. Some children travel as much as 100 miles to get to school.

As of September 2012, North Dakota had a $1.6 billion surplus. This does not include the $1.9 billion in three restricted state funds or the $1 billion set aside for public works projects and property tax cuts.

This begs an important question. When a state is financially strapped and must make cuts to essential services to balance the budget, decisions such as cutting a free milk program is understandable. But, when a state has the money to pay for it, and chooses to not pay for milk for 6,000 poor children, questions the morality of the state and forces the public to ask where is the state’s priorities.

And should we be putting hydrofracking revenue before children’s lives?

On oil profits

Halliburton, the second largest oilfield services company in the world, posted record profits in 2012. Even excluding a $300 million charge related to the rupture of the Macondo Well in the Gulf of Mexico, Halliburton earned $627 million — or 89 cents a share — for the first quarter 2012.

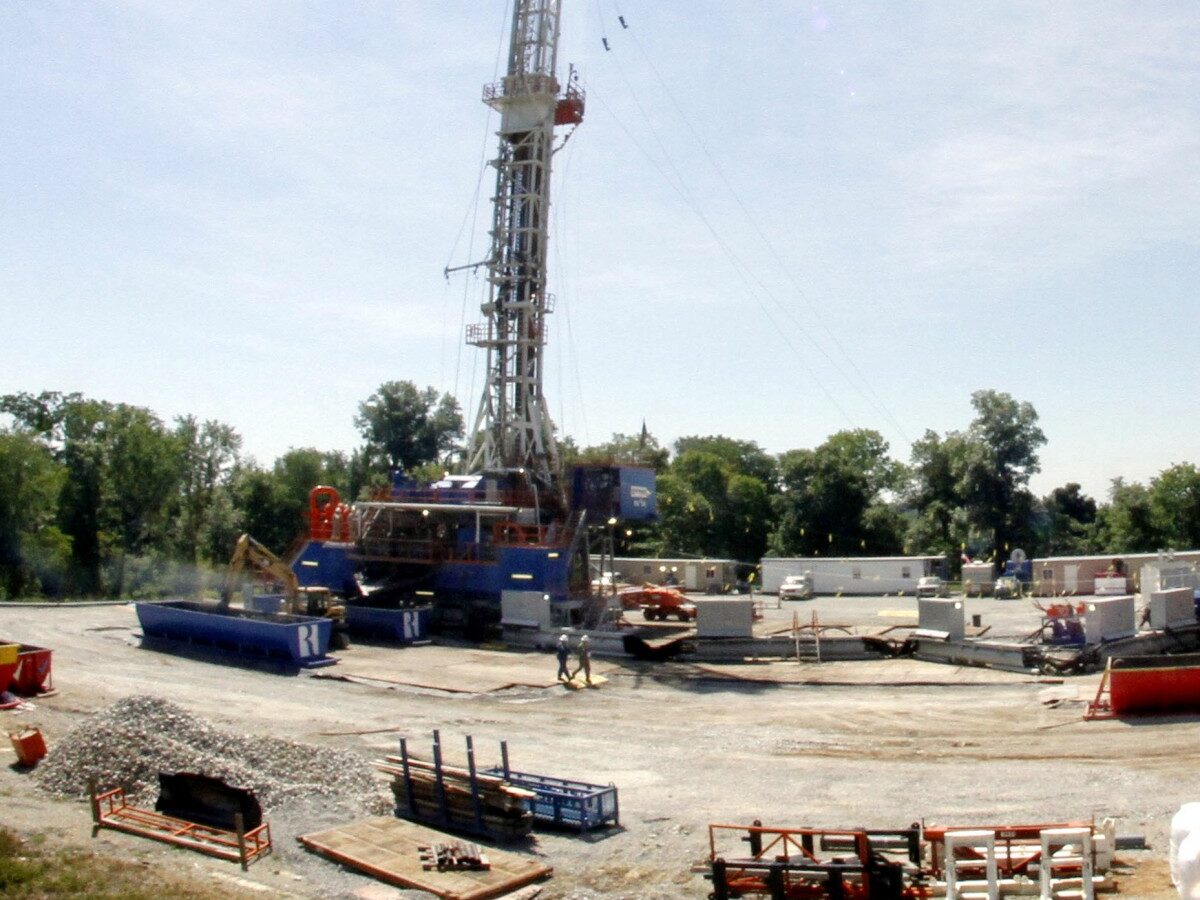

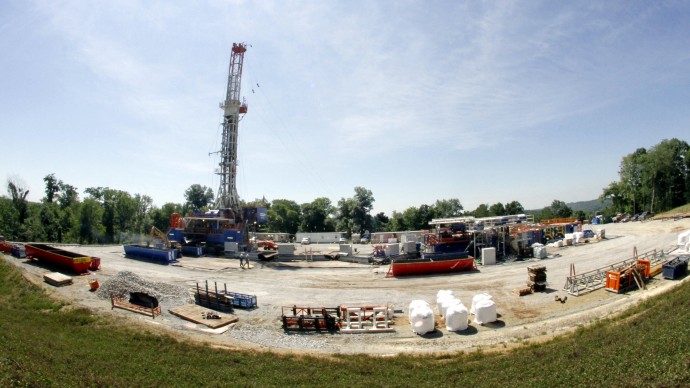

Halliburton is the United States’ largest hydraulic fracturing, or hydrofracking, operator. Hydrofracking is a form of natural gas and shale oil drilling in which high-pressure fluids shatter shale formations, releasing carbon deposit pockets cached in the rock.

Halliburton Chief Executive Officer Dave Lesar announced a 30 percent jump in revenue for 2012 to $6.9 billion. North American revenue jumped 40 percent to $4.1 billion.

Halliburton’s profit comes largely as a result of a shifting world economy. Increasing domestic consumption, competition for oil exports with China and Russia and shortages due to embargos and export controls, have led to oil prices to new highs in the United States.

It is now thought that the United States will produce enough oil and natural gas to be self-sufficient by 2030. The United States is likely to surpass Saudi Arabia in oil production within the next five years, and non-OPEC (Organization of Petroleum Exporting Countries) oil production will dominate the growth of the global supply of petroleum in the upcoming decade.

The nature of artificial crude oil

This is due, in part, to discoveries of bitumen-rich oil sands in Alberta, Canada, and shell oil deposits in the Bakken Formation in eastern Montana and western North Dakota and the Marcellus Formation of New York and Pennsylvania.

Bitumen — also known as asphalt — is a sticky, smelly, molasses-consistency form of petroleum that, for decades, was used as a sealant for roads (as a sealant, it is known as blacktop or tarmac). While bitumen is a form of petroleum, the cost to fracture the compound into refinable components was prohibitive. However, with the hike in oil prices, bitumen-refining into synthetic crude oil has finally became profitable.

Bitumen is fractured by distilling it at very high temperatures.

Similarly, shale or kerogen oil which is a product of shale hydrofracking can be exposed to high temperatures to produce oil vapor. This oil vapor can then be cooled and separated into unconventional oil and combustible oil-shale gas.

Both bitumen and kerogen distillation is considered by many to be an unnecessary and reckless environmental risk. Spilled unrefined asphalt can penetrate the ground and not only kill the plant and bacterial life, but prevent new life from sprouting in the area for years to come. Petroleum vapors from bitumen and kerogen distillation is immediately dangerous to all life and carries toxins such as uranium and other heavy metals.

The life threatening chemicals used for hydrofracking can cause cancer.. Evidence has shown that — despite efforts to contain the fracking fluids — a considerable amount does escape and can contaminate the local water table and the area’s ecology.

“The Oil Boom” and hard realities

This, however, does not dissuade local and state governments from seeking out companies such as Halliburton, Schlumberger, Weatherford International, National Oilwell Varco and Baker Hughes in an attempt to cash in on the oil boom. An example of this can be found in upstate New York.

Along the western border with Pennsylvania lies a tract of land known as the Southern Tier. Reaching from the Catskill Mountains to Lake Erie, the Southern Tier is a formerly heavy industrial area. Companies such as Johnson & Johnson, Corning Glass and IBM all found their starts there, but economic shifts drove them away. Agriculture, the region’s major industry presently, does not give the region the economic power to keep up with other regions of the state, and the region and its people find themselves in unsure waters financially.

The Southern Tier sits on the Marcellus Formation, a subgroup of shale formations in the Hamilton Group, which extends throughout the Appalachian Basin. The Marcellus Formation formed at the end of the Devonian Period — about 419 million years ago, give or take 3 million years — and, as such, is one of the oldest formations to bear fossilized organic remains — coal. The Marcellus Formation is the bedrock layer in western New York, northwestern Pennsylvania and northeastern Ohio.

The people of the Southern Tier see the Marcellus Formation and the natural gas reserves it holds as an answer to their prayers. Property owners typically receive lease payments from drilling companies for permission to drill on their lands for an upfront fee and a percentage of any sales for gas or oil extracted. The municipalities and counties also receive proceeds in regards to sale tax on the gas and due to increased business in the area.

However, the state of New York currently issued a moratorium on hydrofracking until the environmental factors of the process has been measured. Environmentalists argue that it poses the risk of contaminating groundwater and deep aquifers and presents other hazards like air pollution from heavy truck traffic.The gas companies counter that the drilling will bypass drinking water supplies completely and that it will be governed by strict state environmental regulations.

Currently, more than 100 communities in New York and Pennsylvania ban hydrofracking in their watershed area, under the states’ home rule provisions. Many landowners that have previously signed leases with the oil companies, but haven’t had their lands drilled yet due to state restrictions. Many are starting to regret signing the lease in the first place.

Landowners whose oil leases are set to expire have found out that they were renewed without their consent. The companies invoked a legal maneuver known as force majeure, which entails the continuation of an agreement if unforeseen circumstances prevent the two sides of the agreement from satisfying an agreement. The companies argue that the state prevented them from drilling, so their leases are still valid until they get to drill, regardless of expiration date.

Other landowners feel that they were not given fair value for the terms of their leases. A group called Fleased has started in Western New York to address landowners’ concerns about their oil leases. As stated on its website, “Fleased is providing a voice for fellow landholders who leased mineral rights before we knew that shale gas exploitation threatened our land, air, water and communities. Many landholders signed leases with gas companies before shale gas exploitation was anticipated in New York State. Why did we sign? Partly because natural gas was portrayed as a relatively “clean green” fuel, so obtaining it locally seemed reasonable. Partly because the way it was presented to us made it sound not only benign, but inevitable.”

“Previous gas drilling was far less dangerous than the slickwater high volume hydraulic fracturing used for shale gas exploitation. And the older technology is what most of us thought we signed up for,” the website continues. “Our expectations were based on conventional gas drilling. None of us knew that toxic chemicals would be injected into the land under our homes, woods, farms and wells.Had we known about the pollution potential and the possible transformation of peaceful residential and agricultural areas into industrial zones, we would never have signed.”

New York State itself was hit by force majeure when Chesapeake Energy informed the state’s Department of Environmental Conservation that it will extend the leases on more than 15,000 acres of state land.

There are currently more than 400 lawsuits filed against the gas and oil companies from New york State residents alone. Some fear that the companies failed to adequately explain “hydrofracking” and feel that drilling may contaminate a neighbor’s water — which would expose them to liability — or permanently devalue or contaminate their land. Others want their leases to reflect market value. Chesapeake Energy has offered as little as $3 per acre with a 12.5 percent royalty, when the current market average is $5,000 to $6,000 an acre with 20 percent royalty. Many simply just want to end their lease.

Despite this, many in the Southern Tier are eager for the state to drop their objections to hydrofracking — the call of easy money is too great.

The cost of hydrofracking

Once the hydrofracking boom ends, there may be a heavy price to pay. Environmentalists are now just starting to understand the ecological cost of hydrofracking, including the contamination of the national water supply . Water is becoming more and more a critical resource as the population swells; wastewater released from hydrofracking operations can have radioactive elements in concentrations thousands of times above the federal limit and causes permanent damage to the bedrock which may lead to earthquakes and surface instability and atmospheric contamination.

As reported in The Hill, “The U.S. Geological Survey reported in April that the number of seismic events in our country’s midsection has risen from about 21 in the 1990s to 50 in 2009, 87 in 2010 and 134 in 2011. The scientists concluded that fracking — when water, sand and chemicals are injected into the Earth’s deep shale formations to break up rock and extract the natural gas – was the most likely cause.”

Agricultural production on this contaminated land may be permanently compromised, livestock may develop mutations and defects.

The most damning argument of all in regard to hydrofracking is the cost breakdown. In an article for Seeking Alpha, Mark Anthony analyzed the per-barrel cost and profit for shale oil harvested from the Bakken Formation by Whiting Petroleum. As presented by Anthony, Whiting earned about $71.88 per barrel with an operating cost of $23.62 per barrel and an amortization of capital cost of $21.71 per barrel, leaving a gain of $26.55 per barrel.

However, as Anthony points out, to maintain the wells’ output, the amortization rate on the capital cost must be greater than reported. Based on previous analysis that Bakken shale wells decline to 0.2 percent a day, Anthony determined that the real amortization of capital cost is $144.12 per barrel.

So, Whiting actually gets $71.88-$23.62-$144.12=$-95.86. Whiting loses $95.86 per barrel. If this is reflective of all shale oil operations in the Bakken, the entire industry is prone to collapse.

Many feel that this boom may turn bust sooner than later. J. David Hughes of the Post Carbon Institute said, “Wells decline rapidly within a few years. Those in the top five U.S. plays typically produced 80–95 percent less gas after three years. In my view, the industry practice of … inferring lifetimes of 40 years or more, is too optimistic … Governments and industry must recognize that shale gas and oil are not cheap or inexhaustible: 70 percent of U.S. shale gas comes from fields that are either flat or in decline. And the sustainability of tight-oil production over the longer term is questionable … Declaring U.S. energy independence and laying plans to export the shale bounty is unwise.”